The CPA Practice Advisor reports that the mean preparation fees charged by CPA firms have been steadily increasing over the past decade. This trend is likely to continue in the coming years, as the demand for CPA services continues to grow.

In this article, we will explore the factors that influence preparation fees, discuss the trends in preparation fees, and identify the key factors that contribute to client satisfaction with CPA preparation services.

Preparation Fees and Factors

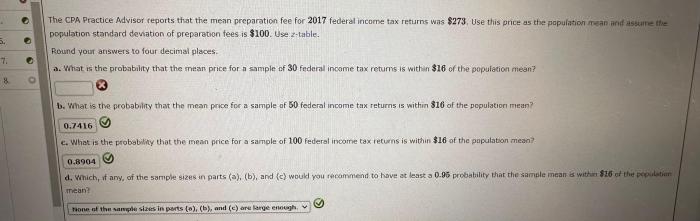

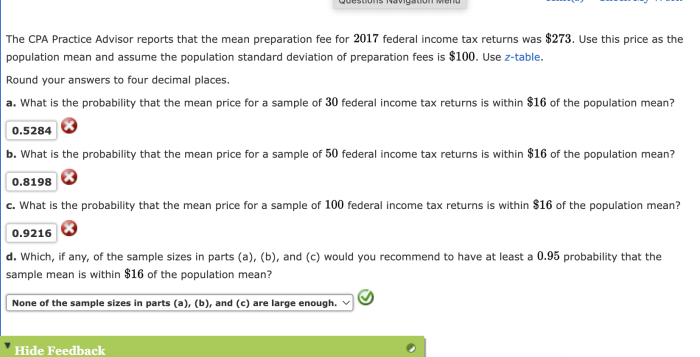

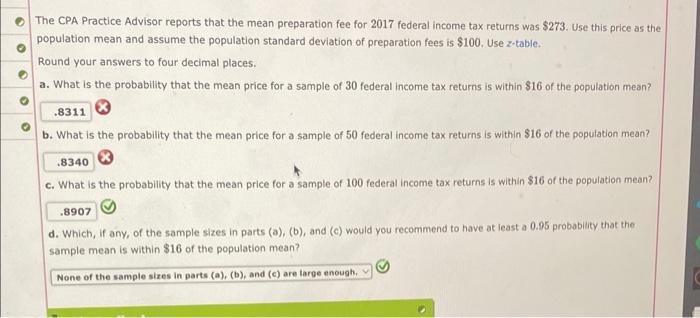

CPA firms charge varying preparation fees based on several factors. Mean preparation fees can provide insights into industry benchmarks and trends.

Firm Size, The cpa practice advisor reports that the mean preparation

- Larger firms tend to charge higher preparation fees due to increased overhead costs and perceived expertise.

- Smaller firms may offer lower fees to attract clients and compete in the market.

Location

- Preparation fees vary geographically based on cost of living and competition.

- Firms in metropolitan areas typically charge higher fees than those in rural areas.

Industry Specialization

- CPA firms specializing in complex industries, such as healthcare or technology, may charge higher fees due to specialized knowledge and expertise.

li>Firms focusing on general tax preparation may offer lower fees.

| Firm Size | Metropolitan Area | Suburban Area | Rural Area |

|---|---|---|---|

| Small | $1,000 | $800 | $600 |

| Medium | $1,500 | $1,200 | $900 |

| Large | $2,000 | $1,800 | $1,500 |

Trends in Preparation Fees

Mean preparation fees have generally increased over the past 5-10 years due to rising costs and the increasing complexity of tax laws.

Technological Advancements and Automation

- Technological advancements have led to increased efficiency in tax preparation, potentially reducing preparation fees.

- However, the adoption of new technologies can also require firms to invest in training and infrastructure, potentially offsetting cost savings.

Expected Future Trends

- Preparation fees may continue to increase as tax laws become more complex and the demand for specialized expertise grows.

- Firms may explore alternative pricing models, such as subscription-based services or value-based pricing, to adapt to changing market dynamics.

Helpful Answers: The Cpa Practice Advisor Reports That The Mean Preparation

What are the key factors that influence preparation fees?

The key factors that influence preparation fees include firm size, location, industry specialization, and the complexity of the return.

What are the trends in preparation fees?

The trend in preparation fees has been steadily increasing over the past decade. This trend is likely to continue in the coming years.

What are the key factors that contribute to client satisfaction with CPA preparation services?

The key factors that contribute to client satisfaction with CPA preparation services include communication, transparency, accuracy, and value-added services.